Insurance

Data-Driven Improvement to Better the Organization

Featured Industry

- Insurance Industry Module

- Expedite Claims

- Improve Retention and Customer Satisfaction

- Intelligent Underwriting & Predictive Analytics

- Implement an Improvement Program

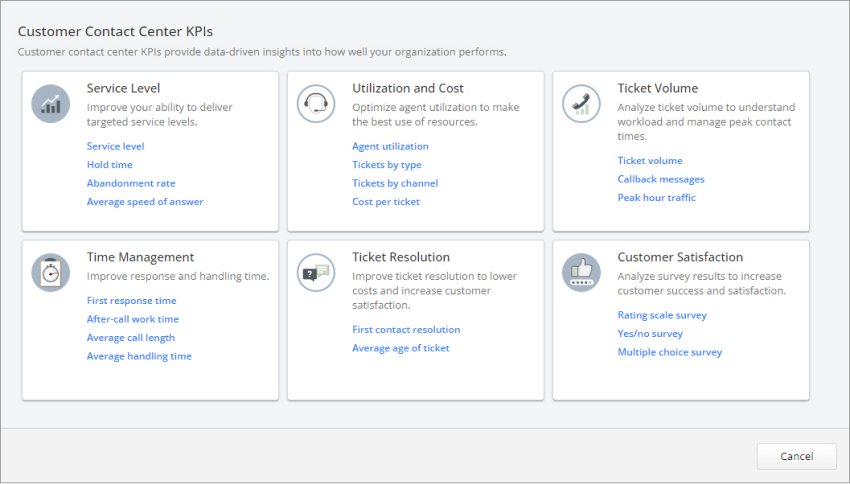

- Customer Contact Center

- Service Quality Training

Insurance Industry Module

With Minitab's Insurance Industry Module, you don't have to learn statistics to analyze your data. Our solution allows you to collect data in real-time or analyze it later. You'll be able to easily interpret your findings to make improvements that help grow your top line, predict costs and improve customer satisfaction.

Let our solution make analysis easier, so you can concentrate on what really matters, such as improving key performance indicators (KPIs) like time to settle a claim, underwriting speed, revenue per policy holder, claims ratio and more. If you have any questions, we're here to help you every step of the way through your analysis. Simply reach out to our industry-leading technical support team via phone or email for assistance.

Leverage Data Analysis and Process Improvement to Improve Performance

With uncertainty surrounding interest rates and increasing competition, you need to find ways to increase productivity and boost your bottom line. Even if you have the smartest actuaries analyzing data about your products, premiums and risks, you need to leverage your organization's data to identify opportunities and assess risks. That's where we come in.

Minitab provides you with user-friendly interfaces that allow for deeper and more thoughtful data analysis.

Minitab’s solutions allow you to:

- Access your own data for analysis to drive improvements

- Identify key drivers of claims to expedite and predict future claims

- Grow revenues through a better understanding of your policies and sales effectiveness

- Predict and mitigate customer churn

- Leverage the power of Minitab’s algorithms to analyze credit risk, default risk or even event risk

- Improve performance processes and the customer experience all over your organization with structured problem-solving tools

DID YOU KNOW?

Over 70% of the Insurance Companies in the Fortune 100 partner with Minitab to improve their bottom line.

DID YOU KNOW?

100% of the Fortune 100 and Over 90% of the Fortune 500 Insurance Companies partner with Minitab to deliver innovation faster and operate more efficiently.

OUR CUSTOMERS

“Minitab created a corporate culture of complete transparency of information…Dashboard building is easy and accessible by all users…Don’t attempt to build your own solution, choose Minitab…”

Carrie B.

Insurance Broker